Download the pdf of this Seattle press release here.

Download the Washington State press release here.

March 24, 2014

Contact: Joaquin (WAH keen) Uy (wee)

206.427.2999 (text or call), joaquin(at)wliha(.)org

The Full Out of Reach 2014 Report is at: nlihc.org/oor/2014.

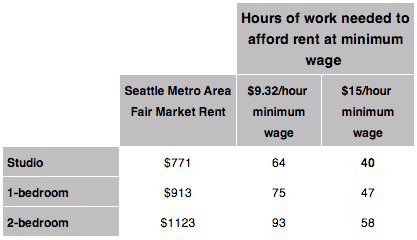

SEATTLE – If you make minimum wage ($9.32) in Seattle, you’ll need to work 64 hours a week to afford the average studio apartment, a slight increase from last year.

This is one of the many findings from the Out of Reach 2014 report, jointly released by the National Low Income Housing Coalition (NLIHC) and the Washington Low Income Housing Alliance (Housing Alliance) today.

NLIHC is a national research and advocacy organization based in Washington, D.C. and the Housing Alliance is a statewide housing advocacy nonprofit. The report provides housing affordability data for every state, metropolitan area, and county, including the unique Housing Wage statistic., illustrated below:

The Housing Wage for a studio apartment in Seattle is $14.83. This means a household working 40 hours a week must earn $14.83/hour to afford the rent and utilities for a home in the private housing market. (HUD considers someone as rent-burdened if they pay more than 30% of their income on housing.) The data thus also shows just how dramatically a $15/hour minimum wage would expand housing options for low-wage workers. The Fair Market Rent (FMR) on a studio apartment in the Seattle area ($771, an increase from last year) would actually become affordable to a full-time worker earning $15/hour.

“An increase in wages would go a long way toward helping the lowest paid workers afford a home,” says Rachael Myers, Housing Alliance Executive Director. “And that’s just one side of the equation. This past state legislative session, the Senate failed to pass a supplemental capital budget appropriation. In the past, the capital budget has contained numerous investments for creating more affordable homes. No capital budget this go-around means the affordable housing supply in the state will continue failing to meet growing demand. ”

The FMR for a one-bedroom (1-br) apartment in Seattle is $913 (an increase from last year). Even though the state’s minimum wage of $9.32 is the highest in the country, two minimum wage workers would just barely be able to afford the average 1-br home. And a single parent would have to earn twice minimum wage to rent a home where she and her children have separate bedrooms. Both increasing the minimum wage to $15/hour and an increase of available and affordable 1-br homes would be huge steps in alleviating this housing crisis.

The Housing Alliance believes all Washington residents should have the opportunity to live in a safe, healthy, affordable home. However, as Out of Reach 2014 reveals, every month, thousands of families and individuals have to choose between paying for a roof over their heads or paying for other basic needs like food, medicine, or childcare. The Housing Trust Fund is an extremely effective tool for solving our state’s affordable housing shortage. We will be working to ensure elected officials make an appropriate investment in the Housing Trust Fund in the next legislative session. ###

Learn more about Washington State’s Housing Trust Fund: wliha.org/advocacy/state#HTF.

Learn more about the $15 for Seattle Campaign: goodjobsseattle.org/.

|

Contact: Joaquin Uy |

Contact: Sarah Brundage |

Contact: Sage Wilson goodjobsseattle.org |