Recent Blog Posts

Housing costs continue to rise across Washington, and today's release of the Out of Reach report by the National Low Income Housing Coalition (NLIHC) shows that a full-time worker earning minimum wage in our state would need to work 2.1 jobs to afford a modest one-bedroom rental home at fair market value.

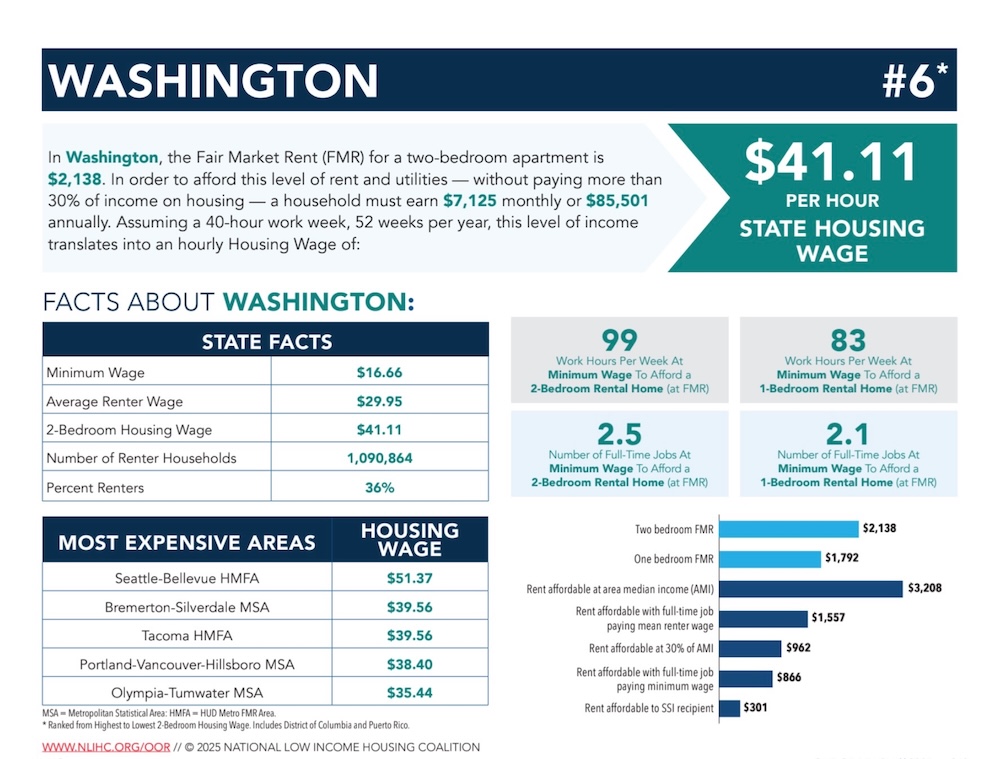

The housing wage, or the hourly amount that a person needs to earn to afford to rent a two-bedroom rental home has risen to $41.11 per hour, an increase of $0.79 per hour from last year. Meanwhile, minimum wage across the state rose by $0.38 per hour to $16.66 per hour.

The impacts of needing to work more than one job to be able to afford housing is well known to Q Fernandes, who lives in Lynnwood. They work full time as a housing case manager.

"A lot of people I talk to tend to be surprised that someone six years deep into their full-time professional career with a 4-year degree from UW still needs multiple jobs to stay afloat, and I really think that needs to be talked about more," Q said. "No one should ever have to work multiple jobs to survive, but the stereotype many people have of someone who needs to work 2-3 jobs is extremely narrow compared to reality."

The fair market rent for a two-bedroom apartment in Washington rose in this year's report to $2,138. To afford this level of rent and utilities, without paying more than 30% of income on housing, a household would need to earn at least $7,125 a month or $85,501 per year - a figure far from the reach of those working at or near the minimum wage. The state housing wage of $41.11 per hour ranks Washington as sixth in the nation for the most expensive housing wage.

"Housing costs continue to rise beyond the incomes of far too many households in Washington, especially those working for low wages," said Rachael Myers, Executive Director of the Washington Low Income Housing Alliance. "We are grateful that renters across the state no longer have to face the scary prospects of exorbitant rent increases, with the passage of House Bill 1217 earlier this year, but we still need to do more to ensure that every household in our state can afford to live in a safe home."

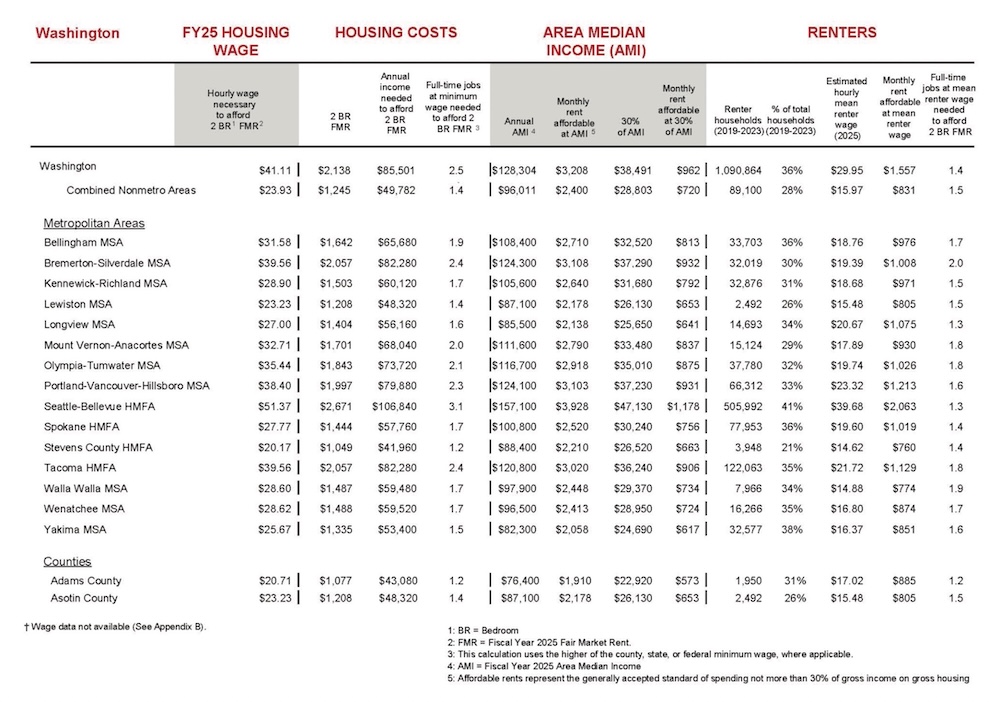

The housing wage varies across different areas in Washington. Those living in the Seattle and Bellevue metropolitan area, which includes King and Snohomish counties, face a housing wage of $51.37 per hour to be able to afford a two-bedroom rental home, while those in Tacoma and the Bremerton-Silverdale area face the second-highest housing wage at $39.56 per hour.

The lowest housing wage in Washington is found in rural counties, where the cost of housing is still out of reach of full-time minimum wage workers. Ferry County has the lowest housing wage in the state at $17.94 per hour, followed by Lincoln County at $19.63 per hour.

Significant disparities between what renters earn and their housing costs leave their housing security especially precarious during periods of economic uncertainty, and this is especially the case for families who are Black, Indigenous, and other people of color. Out of Reach 2025 sheds light on how recent economic downturns have led to long-term increases in the prevalence of housing cost burdens among the lowest-income renters. Housing cost burdens prevent low-income renters from affording other basic necessities and also keep them at constant risk of housing instability.

Despite urgent housing affordability challenges and economic uncertainty, the future of federal housing assistance is at risk. Current federal budget proposals threaten significant cuts to housing assistance programs and the loss of thousands of housing vouchers. The president's budget request for FY 2026 proposes a devastating 44% cut to the Housing and Urban Development's overall funding, which would eliminate rental assistance programs, consolidate five key programs into a single, restrictive State Rental Assistance Block Grant, and impose a two-year time limit on assistance. The Trump Administration is also expected to pursue harmful regulations that would make it more difficult for families to obtain and maintain HUD assistance, including burdensome work reporting requirements.

"Housing is more than just a shelter; it is foundational to well-being and dignity," said NLIHC President and CEO Renee Willis. "This year's Out of Reach report shows that, despite economic gains for some, low-income renters continue to face impossible choices between paying rent and meeting basic needs. Cutting federal housing investments would only deepen the crisis. Congress must protect and expand housing programs that ensure stability, opportunity, and a pathway out of poverty for millions of renters."

For additional information, and to download the reports, visit: http://www.nlihc.org/oor. The website includes the national report as well as data specific to Washington.

Add new comment